Having to collect payments is probably the hardest part of both social and professional life.

People aren’t too keen on giving money back due to a wide variety of reasons. However, a miscalculated payment collection approach might cause significant tension and possibly sour both societal and business relationships.

Therefore, taking the most innocuous approach to remind people about due payments is often the best way. After all, it’s entirely possible that someone has been overloaded with work or daily life and simply forgot to send the payment. Trying to first engage with them in a friendly manner is likely to increase success rates.

That’s why sending payment reminder text messages is so powerful. It’s a method that is not pushy and serves as a basic reminder. Additionally, you can expect it to be extremely effective as nearly everyone checks their phones several times daily.

Want to find out how you can empower your SMS marketing and email campaigns even further? Check out the Sender blog for more information, or check out our free multichannel marketing solution!

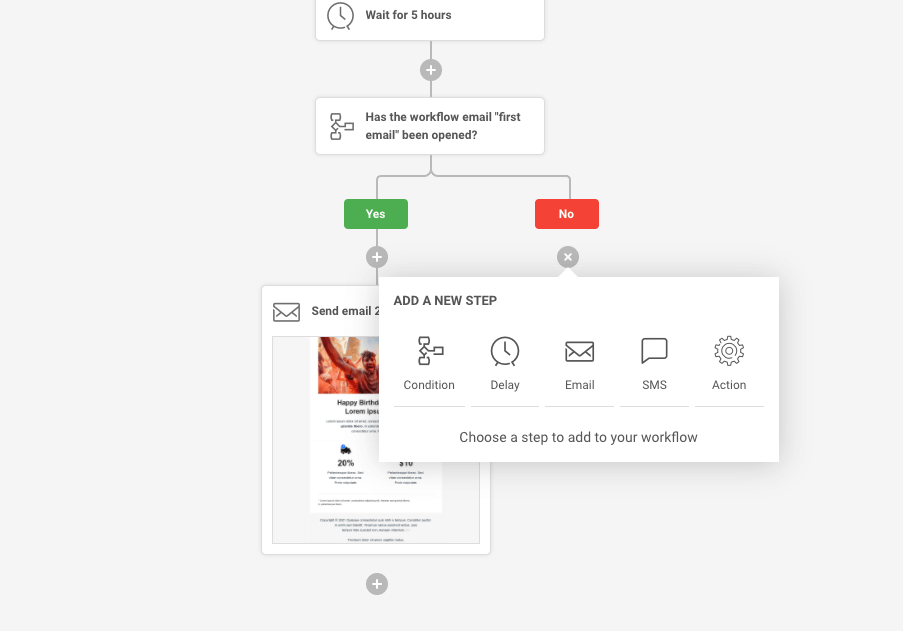

Keep in mind that each payment reminder SMS message or email can be easily automated with Sender. See how easy it is:

Scheduled (Loan) Payment Reminders

Before things get heated, it’s essential to send scheduled payment reminder text messages. According to studies in healthcare and other SMS marketing statistics, sending scheduled reminders for appointments increases attendance. The same applies to payments.

Simply sending out a payment reminder ahead of time can increase collection rates and reduce the involvement of customer support. Instead of sending out scary due payment reminders that are likely to cause negative emotions, using SMS messages can solve the problem before things get sour.

- Hello, [name]! This is [institution name]. We’d like to remind you that payment for [$] will be due by [date]. For more information, visit our website [URL].

- Hey, [name], we’re sending out a reminder about a scheduled payment for [$] that will be due by [date]. [Institution name].

- We’d like to remind you that your next loan payment will be due in [days left]. To pay, visit our physical venue or website at [URL].

Gentle Payment Reminders

Soft payment reminders are the best course of action in cases where the client or person has simply missed a payment and little time has passed.

Sending a soft text message payment reminder will get their attention and, if they honestly forgot, will likely cause them to clear the debt as soon as possible.

- We want to remind you that [$] sum is due for payment since [due date]. For more information, log in to your account [URL] or call us at [phone number]. Regards, [institution name].

- Hey, [name]! We’re here to remind you that payment for [$] has been awaiting payment since [due date]. More info: [URL]. [Institution name]

- Hello, [name]. Remember that a [$] sum is still outstanding on your account. To avoid additional fees, please pay the required sum until [date]. Regards, [institution name].

Strong Outstanding Payment Request SMS Reminders

When soft payment reminders don’t work, turning to harsher language might be a necessity. Generally, informing the customer about impending issues if he or she fails to make a payment is a way to get nearly anyone’s attention.

However, it should always be mentioned that previous attempts at communication have been made. Such mentions cover two bases – the legal (as it’s easier to make a case in court that reasonable attempts at communication have been made) and courtesy.

People sometimes forget things several times in a row. Remaining courteous allows you to maintain good relations with those customers.

- Dear [name], We have tried to reach you regarding an outstanding payment since [date]. Unfortunately, if the payment has not been covered by [last due date], we will be forced to cut off [services]. Regards, [Institution name].

- Dear [name], we have still not received a [$] payment. Its due date has been [due date]. Should your payment fail to arrive in [#] days, we will pursue legal action. We urge you to make the payment as soon as possible. [Institution name]

- This is a final reminder that we have not yet received payment for [$] since [due date]. If no payment is made by [date], we will have to move the case to court. [Institution name].

Final Overdue Payment Reminders

This is where it gets serious. These SMS messages are basically the final line of communication as companies inform their clients that they are pursuing legal action. They also provide one final opportunity to resolve the disagreement outside of court.

There are no pleasantries left. However, sending the final reminder is important as it may aid in court and works as one final scary push. Some people might only be afraid of legal action and avoid paying until it comes to that.

- Dear [name], After several attempts at communication, we have not received the due [$] payment. We are now forced to take legal action. If you think this is a mistake, call us at [phone number]. [Institution name]

- Hello, [name], despite our previous reminders, we have still not received the [$] since [due date]. We have no other choice but to take legal action against you. Call [phone number] to contact us. [Institution name]

- Unfortunately, due to a failure to pay [$] sum since [due date], we, [institution name], are forced to pursue court action. Contact us through [phone number] for more information.

SMS Payment Reminder Format

Sometimes using templates or pre-written examples just doesn’t cut it. Building your payment reminder text message might seem the correct thing to do. You’ll need to keep a few things in mind when building one:

- Adjust language accordingly. You don’t want to sound like the Italian mob if the client hasn’t paid a small outstanding fee for a week. Payments are a very sensitive topic. Therefore, it’s often better to sound softer (after all, legal action will always be available) rather than rough right off the bat.

- Make sure to include your institution. Sending out payment reminders without giving out a name is a foolproof way to arouse suspicion. Who would trust a seemingly random text message that says they need to make a payment?

- Include the necessary details. Including payment amounts, due dates, and other details is not just for courtesy. In some countries, failure to communicate properly with a debtor might make pursuing legal action harder.

- Provide ample time. You want to make sure to take it slow. Sending out payment reminders and telling clients that you will pursue legal action if the required sum does not arrive by tomorrow is a guaranteed way to sour the relationship.

- State previous communication attempts if possible. Again, these can work as both good reminders and will strengthen your legal case if things go to course. Additionally, it helps retain good relations with clients as they might be missing your messages accidentally or due to software bugs. Remaining courteous even in the worst scenario will preserve the most clients in cases of miscommunication.

Following the SMS payment reminder format and using the examples outlined above will nearly always give you a powerful result.

Also read: